Equity Valuation

About this lecture

This lecture aims to walk through a practical application of Valuation and Financial Modeling using the tools that we have developed thus far

- A Valuation is nothing more than an assessment of a firm (or project)’s value

- Based on the current and past information about the firm, project, and industry, we estimate its future results and evaluate how much it is worth in terms of the current period

We will closely follow (Berk and DeMarzo 2023), Chapter 19, which presents the valuation case

You can also use these guidelines to value other publicly held companies

Whenever you’re in doubt regarding a specific term, refer to the previous lectures, which will be, in all possible cases, mentioned throughout these slides

An accompanying Microsoft Excel file available on eClass® with all the calculations

About the company

Ideko is a privately held designer and manufacturer of specialty sports eyewear

In mid-2005, its owner and founder, June Wong, has decided to sell the business, after having relinquished management control about four years ago. As a partner in KKP Investments, you are investigating purchasing the company

If a deal can be reached, the acquisition will take place at the end of the current fiscal year. In that event, KKP plans to implement operational and financial improvements at Ideko over the next five years, after which it intends to sell the business

You believe a deal could be struck to purchase Ideko’s equity at the end of this fiscal year for an acquisition price of $150 million, which is almost double Ideko’s current book value of equity.

Question: is this price reasonable?

Step 1: analyzing comparable firms

As you saw in the Financial Analysis lectures (2-4), one of the first steps in assessing a firm’s value is to understand how comparable firms behave in terms of financial indicators

A quick way to gauge the reasonableness of the proposed price for Ideko is to compare it to that of other publicly traded firms using the method of comparable firms (also known as multiples)

More specifically, market-valuation multiples rely on the fact that a reasonable estimate for a firm’s value should be a factor of its earnings:

- If the industry-median EV/EBITDA is 3.2x, our firm is valued at…

- If the industry-median EV/Sales is 1.2x, our firm is valued at…

- If the P/E ratio is 15x, our firm is valued at…

\(\rightarrow\) For a more detailed discussion on market-valuation ratios, refer to the Financial Analysis lecture here

Step 1: analyzing comparable firms

| Ratio | Ideko (proposed) | Oakley | Luxxotica | Nike | Sporting Goods |

|---|---|---|---|---|---|

| P/E | 21.6 | 24.8 | 28 | 18.2 | 20.3 |

| EV/Sales | ? | 2 | 2.7 | 1.5 | 1.4 |

| EV/EBITDA | ? | 11.6 | 14.4 | 9.3 | 11.4 |

| EBITDA/Sales | ? | 17% | 18.50% | 15.90% | 21.10% |

For example, at a price of $150 million, which is your first estimate of the acquisition price, Ideko’s price-earnings (P/E) ratio is \(\small 150,000/6,939 \approx 21.6\)

Use the numbers presented in the next slide to calculate the:

- EV/Sales

- EV/EBITDA

- EBITDA/Sales

Step 1: analyzing comparable firms

| Ratio | Ideko (proposed) | Oakley | Luxxotica | Nike | Industry Average |

|---|---|---|---|---|---|

| P/E | 21.6 | 24.8 | 28 | 18.2 | 20.3 |

| EV/Sales | 2 | 2 | 2.7 | 1.5 | 1.4 |

| EV/EBITDA | 9.1 | 11.6 | 14.4 | 9.3 | 11.4 |

| EBITDA/Sales | 21.7% | 17% | 18.50% | 15.90% | 21.10% |

- A quick look at this table reveals that:

- Some multiples vary substantially across firms

- Other multiples are more stable

- Differences may stem from differences in operating performance and other firm-specific characteristics

- How to use these numbers to price Ideko’s shares?

Step 1: analyzing comparable firms

At the proposed price, Ideko’s P/E ratio is low relative to those of Oakley and Luxottica, although it is somewhat above the P/E ratios of Nike and the industry overall. The same can be said for Ideko’s valuation as a multiple of sales

Thus, based on these two measures, Ideko looks “cheap” relative to Oakley and Luxottica, but is priced at a premium relative to Nike and the average sporting goods firm

The deal stands out, however, when you compare Ideko’s enterprise value relative to EBITDA:

- \(\small 9.1\times\) is below that of all of the comparable firms

- However, \(\small 21.7\%\) EBITDA Margin is higher than all competitors

Overall, using \(\small \$150\) million as the “correct” price seemed a reasonable estimate

While these multiples provides some reassurance that the acquisition price is reasonable compared to other peers, they ignore important differences such as the operating efficiency and growth prospects of the firms, as well as they look only at past performance

Step 1: analyzing comparable firms

- For each multiple, we can find the highest and lowest values across all three firms and the industry portfolio. Applying each multiple to the data for Ideko yields the following results:

| Minimum | Maximum | Lower Bound | Upper Bound | |

|---|---|---|---|---|

| P/E | 18.2 | 28 | $126.3 | $194.3 |

| EV/Sales | 1.4 | 2.7 | $107.0 | $204.5 |

| EV/EBITDA | 9.1 | 14.4 | $149.9 | $236.0 |

Step 2: integrating the business plan

While comparables provide a useful starting point, whether this acquisition is a successful investment for KKP depends on Ideko’s post-acquisition performance:

If the business plan for the years ahead is substantially different from past performance, then the multiple comparisons may neglect important aspects that should be included in the pricing of the security!

Thus, it is necessary to look in detail at Ideko’s operations, investments, and capital structure, and to assess its potential for improvements and future growth.

All in all, on the operational side, you are quite optimistic regarding the company’s prospects

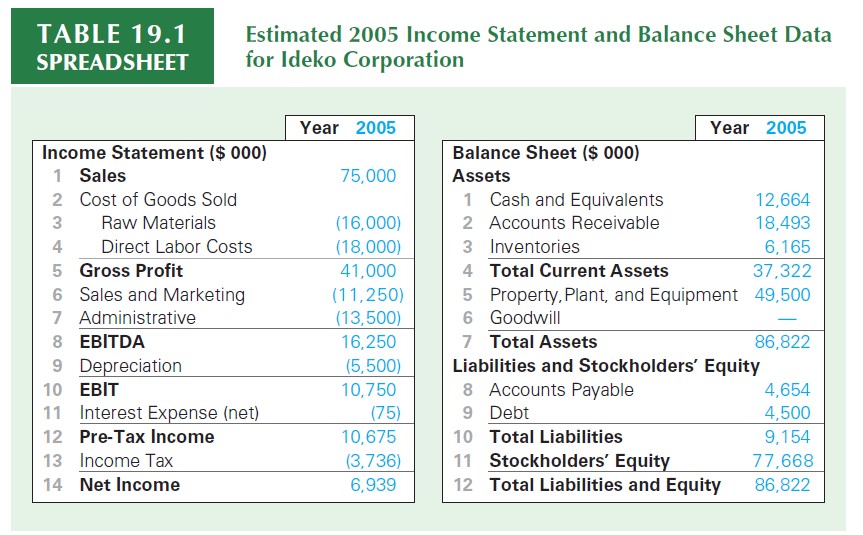

In the next set of slides, you’ll see some numbers from Ideko’s estimated balance-sheet and income statement data as of 2005, as well as some operating forecasts that will be the basis for building the financial model

Balance Sheet and Income Statement

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

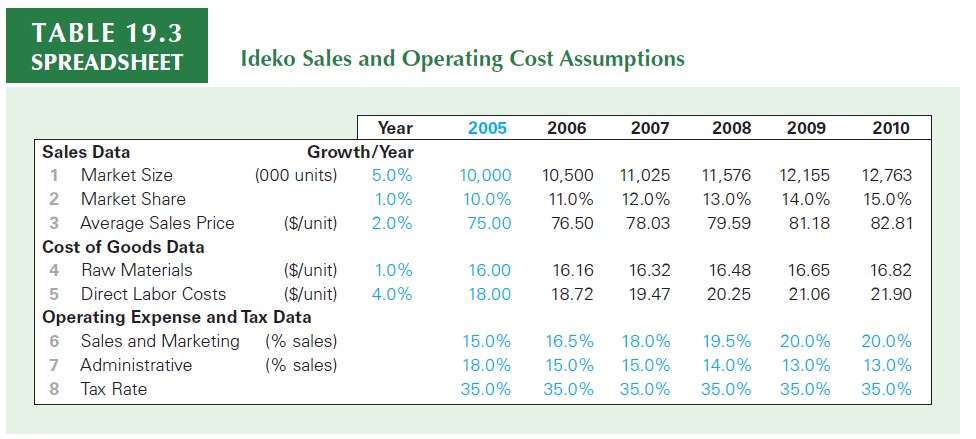

Income and Cost Estimates

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

- The market is expected to grow by \(\small 5\%\) per year as the company produces a superior product

- KKP plans to cut administrative costs and redirect resources to new product development, sales, and marketing, boosting market share from \(\small 10\%\) to \(\small 15\%\) over the next five years

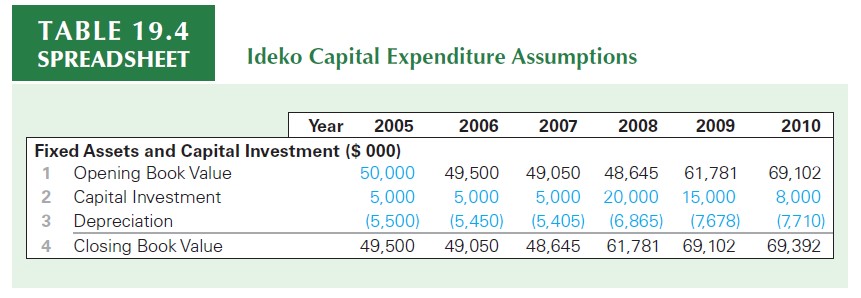

Capital Expenditures

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

The increased sales demand can be met in the short run using the existing production lines by increasing overtime and running some weekend shifts

However, once the growth in volume exceeds \(\small 50\%\), Ideko will definitely need to undertake a major expansion to increase its manufacturing capacity

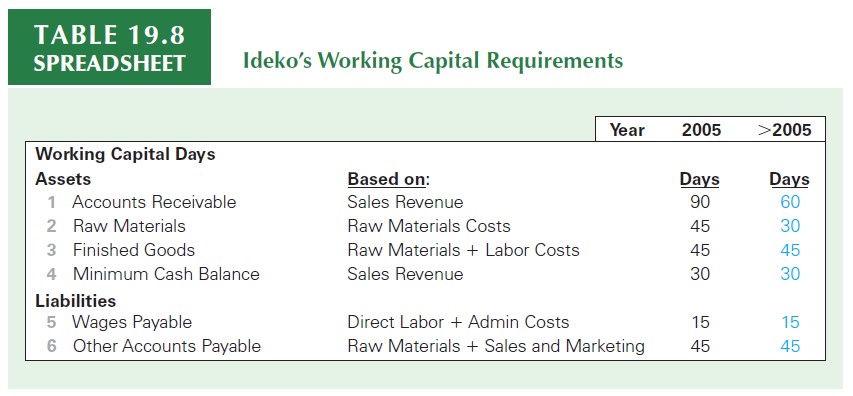

Working Capital Requirements

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

Actual Credit Policy: \(\small 90\) days. While standard for the industry is \(\small 60\) days, you believe that Ideko can tighten its credit policy to achieve this goal without sacrificing many sales

While maintaining a certain amount of inventory is necessary to avoid production stoppages, with tighter controls of the production process, \(\small 30\) days’ worth of inventory will be adequate

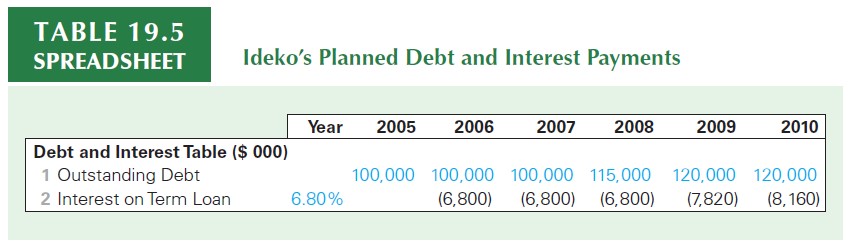

Planned Debt and Interest Payments

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

You plan to greatly increase the firm’s debt, and have obtained bank commitments for loans of \(\small\$100\) million should an agreement be reached

These term loans will have an interest rate of \(\small 6.8\%\), and Ideko will pay interest only during the next five years

You can compute interest expenses by \(r_d \times D_{t-1}\)

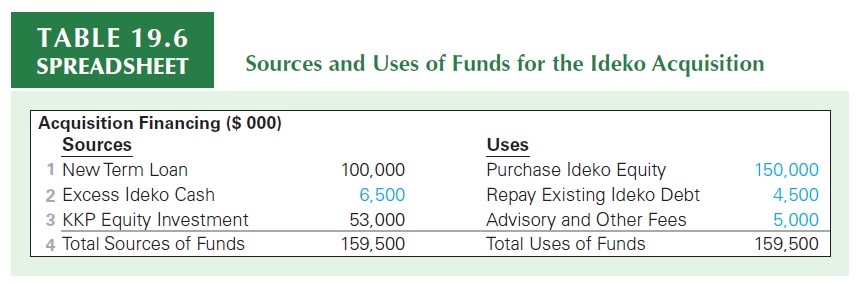

Sources and Uses of Funds

\(\rightarrow\) You can find the hardcoded numbers in the accompaining Microsoft Excel file

- In addition to the \(\small \$150\) million purchase price for Ideko’s equity, \(\small \$4.5\) million will be used to repay Ideko’s existing debt.

- With \(\small \$5\) million in advisory and other fees associated with the transaction, the acquisition will require \(\small \$159.5\) million in total funds

- Required Equity: \(\small 159.5-100-6.5=53,000\)

Step 2: Building the Financial Model

- The value of any investment opportunity arises from the future cash flows it will generate

- With the past information in mind, you begin to forecast Ideko’s future earnings

- To convert this to cash flows, you will also consider Ideko’s working capital and investment needs

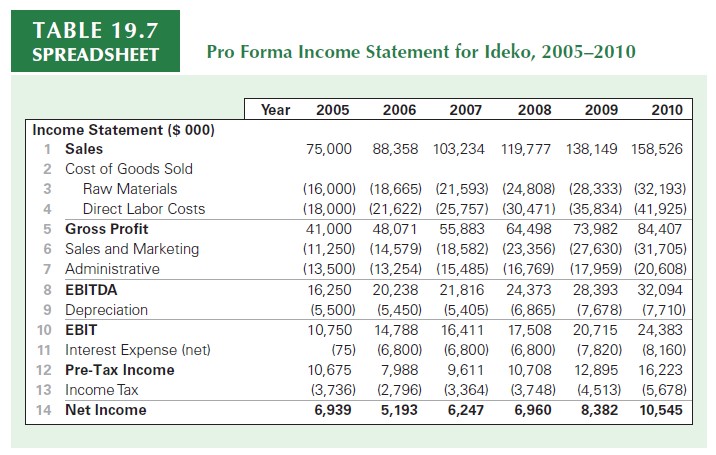

Step 2: The pro-forma income statement

We can forecast Ideko’s income statement for the five years following the acquisition based on the operational and capital structure changes proposed

This income statement is often referred to as a pro-forma income statement, because it is not based on actual data but rather depicts the firm’s financials under a given set of hypothetical assumptions

The pro-forma income statement translates our expectations regarding the operational improvements KKP can achieve at Ideko into consequences for the firm’s earnings.

Start from the sales forecast using your inputs for market size, market-share, and unit prices:

\[ \small Sales_t=\text{Market Size}_t\times \text{Market Share}_t \text{Unit Price}_t \]

Step 2: The pro-forma income statement

- You can use a similar rationale to project COGS, and use the estimated ratios (in terms of sales) to deduct all other operating costs

- You can plug in interest expenses and taxes based on the assumptions discussed before

- You should be able to have your pro-forma income statement like below:

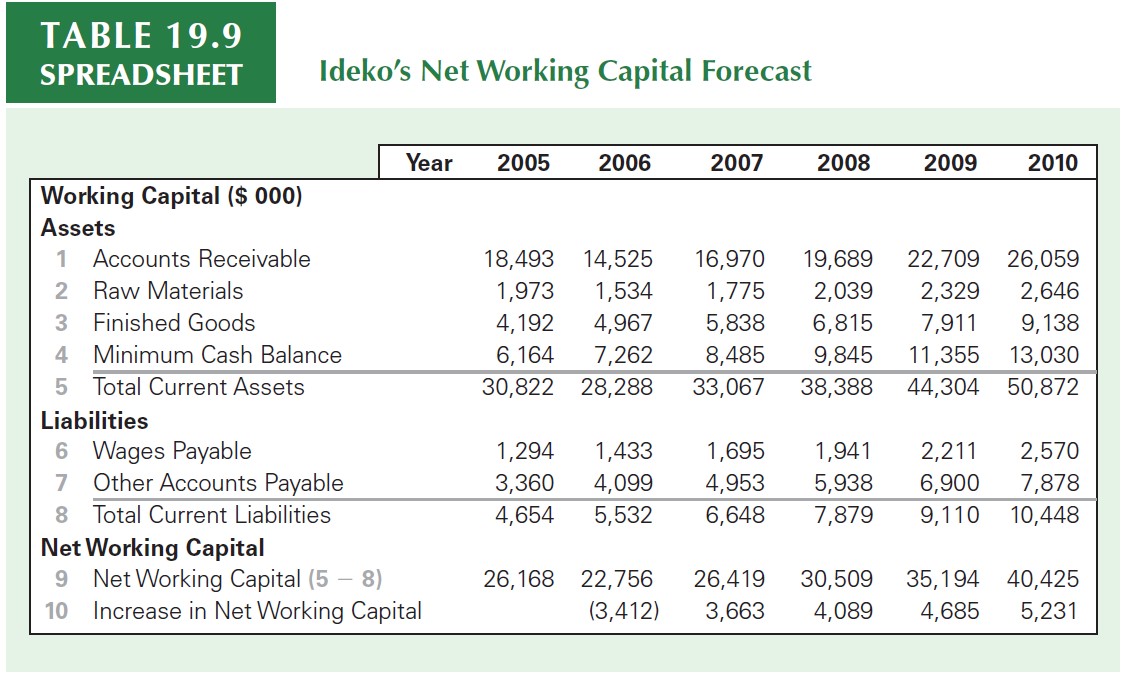

Step 3: Working Capital Needs

- Based on these working capital requirements, you can forecast Ideko’s net working capital (NWC) over the next five years. For example, for Accounts Receivable:

\[ \small \text{Accounts Receivable}= \text{Days Required}\times \dfrac{Annual Sales}{365}\rightarrow 60 \times \dfrac{88,358}{365}\approx 14.525 \]

You can then use the same rationale to project all other working capital requirements across the years, always looking at the yearly forecasts for sales and costs

Finally, you can use the net operating working capital formula to derive the investments needed each year:

\[ \small \Delta NWC_{t} = NWC_{t}-NWC_{t-1} \]

With \(\small NWC_{t}\) defined as Current Operating Assets minus Current Operating Liabilities

Step 3: Working Capital Needs

- Using the estimates described before, you should be able to find:

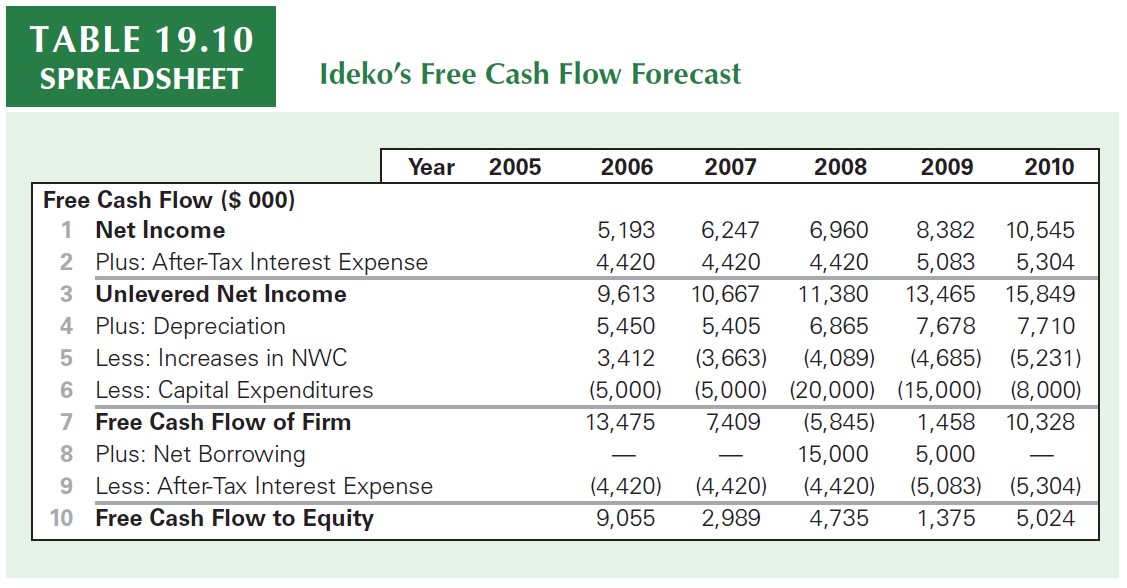

Step 4: Forecasting the Free Cash Flow

We now have the data needed to forecast Ideko’s free cash flows over the next five years:

- Earnings have been estimated in the pro-forma income statement

- You have estimated working capital requirements

- Interest expenses are a byproduct of the interest rate for the loan and the loan size each year

- Depreciation has been estimated by the tax department

- Capital Expenditures are available

You can combine these items to form the Free Cash Flow estimates:

\[ \small FCF_{t}=EBIT_t\times(1-\text{Tax Rate}_t)+\text{Depreciation}_t\pm \Delta NWC_t \pm CAPEX_t \]

\(\rightarrow\) For a detailed discussion on Free Cash Flow, refer to this Fundamentals of Capital Budgeting lecture here.

Step 4: Forecasting the Free Cash Flow

Step 4: Valuing the Investment

You now have the free cash flow estimates, both at the firm level (FCF) and at the equity (FCFE) level

As you saw in Valuation with Leverage lecture, you will now have to evaluate these cash flow streams according to one of the methods (WACC, APV, or FTE)

To value KKP’s investment in Ideko, we need to assess the risk associated with Ideko and estimate an appropriate cost of capital

Because Ideko is a private firm, we cannot use its own past returns to evaluate its risk, but must instead rely on comparable publicly traded firms

In this stage, we will use data from the comparable firms identified earlier to estimate a cost of capital for Ideko

Step 5: Estimating the Cost of Capital

- Based on Oakley, Luxxotica, and Nike, we estimate the firms’ cost of capital using the CAPM:

\[ \small r_U=r_f + \beta_U\times(E[r_{mkt}-r_f]) \]

where \(\small R_f\) is the risk-free market return (in this case, 4%), \(\small r_{mkt}\) is the return on the market portfolio, assumed to be 9% in this case.

- If we are using the CAPM, finding \(\small \beta_U\) is the same approach as of finding \(\small r^U\):

\[ \small \beta_U= \text{% of Equity} \times \beta_E + \text{% of Debt} \times \beta_D \]

- Based on the three comparable firms, we set \(\small \beta_U=1.2\) and then \(\small r_U\) is:

\[ \small r_U=4\%+1.20\times 5\% = 10\% \]

Step 6: Valuing the Investment

- We can apply several techniques to value the investment:

- We can use a multiple (calculated in Step 1) and apply it to the forecasted numbers from Ideko

- Because We can use the APV Method, knowing that because the debt is paid on a fixed schedule during the forecast period, the APV method is the easiest valuation method to apply

- In what follows, we’ll apply each one of these techniques to assess the firm value

\(\rightarrow\) See the accompanying Excel file for the numeric calculations

Step 6: Valuing the Investment: Multiples

Practitioners generally estimate a firm’s continuation value (also called the terminal value) at the end of the forecast horizon using a valuation multiple. While forecasting cash flows explicitly is useful in capturing those specific aspects of a company, in the long run firms in the same industry typically have similar expected growth rates, profitability, and risk

Thus, applying a multiple is potentially as reliable as estimating the value based on an explicit forecast of distant cash flows

In most settings, the EBITDA multiple is more reliable than sales or earnings multiples because it accounts for the firm’s operating efficiency and is not affected by leverage differences between firms

\[ \small V^L=\text{Forecasted EBITDA}\times\text{EBITDA Multiple} \]

\(\rightarrow\) See the accompanying Excel file for the numeric calculations

A reality check

Does our estimate make sense? Our estimate for Ideko’s initial enterprise value is \(\small \$213\) million, with an equity value of \(\small \$113\) million

As KKP’s initial cost to acquire Ideko’s equity is \(\small \$53\) million, based on these estimates, the deal looks attractive, with an NPV of \(\small 113- 53 = 60\) million

Does an initial enterprise value of \(\small \$213\) million for Ideko seem reasonable compared to the values of other firms in the industry?

Here again, multiples are helpful. Let’s compute the initial valuation multiples that would be implied by our estimated enterprise value of \(\small \$213\) million and compare them to Ideko’s closest competitors

\(\rightarrow\) See the accompanying Excel file for the numeric calculations

Supplementary Reading

- See Financial Analytics Toolkit: Financial Statement Forecasting for a detailed discussion on how to forecast future cash flows

\(\rightarrow\) All contents are available on eClass®.